Introduction

Introduction

Though NDC implementation is the core of the Partnership’s mission, mobilizing climate finance to drive successful implementation has been central to our strategy since our founding in 2017. Indeed, financing is the most frequently requested support topic among members and has often been an essential component of the Partnership Plans developed with countries. Now that most countries updated and enhanced their NDCs in advance of COP26, we refocused our attention to implementation, and with that, facilitating finance for both mitigation and adaptation has become even more central to our mission. In 2022, the Partnership launched its Finance Strategy, which provides what we believe are the best solutions to issues that slow and stymie the flow of finance to developing countries who seek to take ambitious climate action. These solutions are matched to the unique role that NDC Partnership members play.

As you will see in this report, the components and pillars of the Finance Strategy were informed by the work we have been performing for several years. The strategy not only serves to refine and focus our finance-related initiatives and support, but to step-up the Partnership’s role in finance, helping maximize the impact of the limited resources available, improving access and creating efficiencies in matchmaking to enable transformational change at greater speed and scale.

How the Partnership works on finance mobilization for NDC action

The Partnership is not a separate finance provider, but a facilitator for its members — countries and institutions — to work more effectively together. A full description of our processes can be found here. Countries share requests and the Support Unit disseminates them to a wide variety of development partners and institutions, who in turn offer their support. As of June 2022, 79 countries are receiving support through the actions of 160 partners, both members and nonmembers, by sharing their requests through the Partnership.

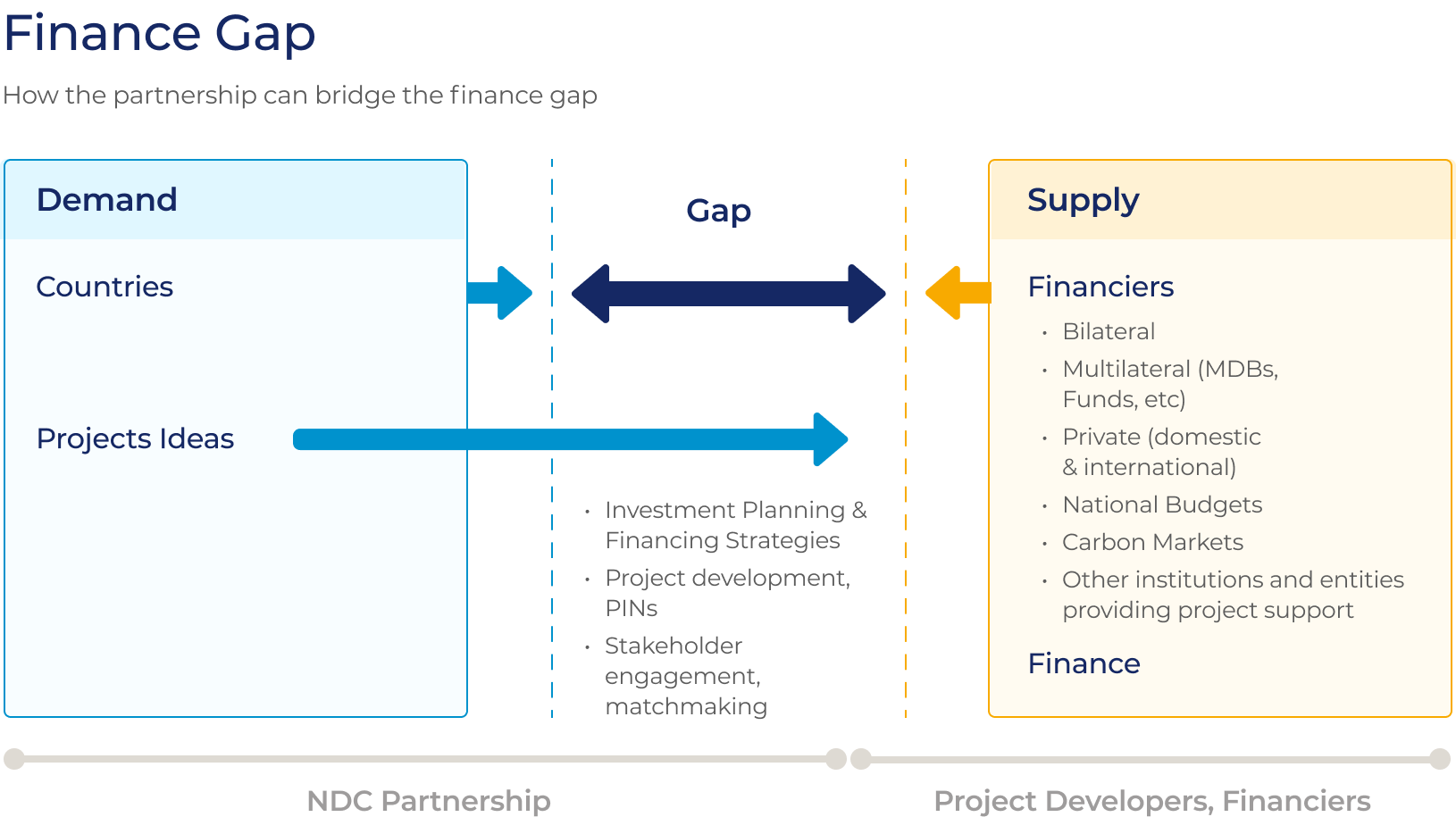

By leveraging the resources and expertise of its members, the Partnership can provide either comprehensive or targeted support on NDC implementation and help bridge the finance gap through its country-led engagement process and Partnership-wide knowledge and learning function.

With countries having put enhanced ambition on the table, it is time to deliver. There is only a short window to show that adaptation and mitigation action can attract the large-scale finance needed to put the world on a safe and sustainable growth path. It is our collective responsibility to facilitate greater investment flows to our member countries and maximize the likelihood of NDCs being financed. With a shared understanding of the challenges at both demand and supply sides of climate finance and strong commitment from all our members to work together to find solutions that are tailored to country-specific needs, we can bridge the gap and achieve a sustainable impact.

The finance obstacles

The realities of climate change require all countries to develop on a low-emission, climate-resilient basis. This requires ambitious NDCs and investment on a vast scale to implement mitigation and adaptation actions. The State of Climate Action 2021 estimates global climate finance needs of USD 5 trillion annually by 2030. Support for developing countries to access the finances they need to take climate action is at the heart of the Paris Agreement. For years, access to finance has proven difficult, and the challenge can be seen from different perspectives.

The first perspective is that there is finance available, it’s just not flowing where it is needed. Public money falls short in many cases, and the global community has not met the goal of mobilizing USD 100 billion per year by 2020. However, there is ample private finance available, with investors looking for viable climate projects and programs to invest in. The problem is that investors are not aware of viable investments. Country “enabling environments” — everything that affects investors’ decisions, from legal processes and clear regulations to pricing regimes and labor availability — are not sufficiently attractive. Government plans are not clear and/or investment-ready enough. Projects are not well designed, developed or communicated. Fix all these problems, according to this first narrative, and countries will have no problems financing their climate plans.

Others see things very differently. Developing countries have established climate plans through their NDCs as well as national adaptation plans (NAPs) and other sectoral plans. In many cases, they identified programs and projects that need finance, but mobilizing and accessing finance is complex and difficult. Funders all have different, often onerous and lengthy, requirements to apply for funds and/or to have projects assessed. According to this perspective, despite the urgency of climate action, neither public nor private finance is available or accessible at speed and scale.

Finding solutions

Collectively, we must bridge the finance gap through efforts from both developing countries (the demand side), who require support, and financiers (the supply side), who can provide support. The Partnership is uniquely positioned to help bridge the finance gap, as we bring together countries that have a demand for climate finance as well as development partners, institutions and private investors that can supply climate finance and related technical assistance. Through the Partnership, developing country members frequently seek support for developing climate finance strategies and roadmaps, integrating NDCs into national planning budgets and revenue streams, project and program financing and resource mobilization, project development and private-sector engagement. In fact, finance is the most frequently requested support area among our members , and to effectively provide support in this area, the Partnership has launched a Finance Strategy. Our Finance Strategy consists of a menu of service offerings, ranging from more “upstream” support for policy frameworks and integration of NDCs into national development plans and budgets to NDC investment planning and more “downstream” support for the identification and preparation of NDC-aligned projects and mobilizing sources of finance. By strengthening existing efforts on climate finance and bringing together some of the world’s largest development finance institutions, including financiers outside of our membership network, the Partnership can be an important platform for financing NDC action.

To accelerate finance mobilization, we need to collectively step up our efforts to narrow the distance between the demand side and the supply side of climate finance. We need to bridge the gap that remains so that countries can access the public and private finance they need for NDC action. Collectively, the Partnership is playing to play a critical role to narrow the gap and match demand with supply to drive low-carbon and climate-resilient development. This requires members to commit to work together to implement solutions.

Demand side solutions

Translating an NDC into an investment plan and then into investment-ready projects is a long, expensive process that demands significant national capacity. In response to country requests, the Partnership provides support for countries to identify and present compelling investment opportunities in numerous ways.

Read More